Why Retirement Looks Different for Women (And How to Plan for It)

Retirement isn’t one-size-fits-all, and for women, it comes with unique challenges.

Women live longer, often earn less over their careers, and are more likely to take breaks from work to care for family. That means they need to stretch their retirement savings further while dealing with lower lifetime earnings. Planning ahead can help bridge the gap.

Why Women Face a Different Retirement Reality

Understanding these factors can help women take the right steps to secure their financial future.

Longer Lifespan, More Savings Needed

Women outlive men by an average of five to seven years, which means their retirement savings must stretch further. A longer lifespan also increases the likelihood of outliving savings, making financial planning even more critical.

Healthcare expenses also rise with age. Women are more likely to require long-term care, which can be costly. Assisted living, in-home care, and nursing homes add a significant financial burden, especially since Medicare doesn’t cover most long-term care expenses. Women must plan ahead to cover these costs, whether through savings, long-term care insurance, or other financial strategies.

Career Gaps and Lower Lifetime Earnings

Many women take time off to raise children, care for aging parents, or support a spouse. These career interruptions mean fewer years in the workforce, reducing overall earnings and opportunities for career advancement. Less time working also results in lower contributions to Social Security, pensions, and retirement accounts like 401(k)s or IRAs.

Additionally, women still earn less on average than men in similar roles. Over a lifetime, this wage gap adds up, leading to lower retirement savings and reduced benefits. Women must take proactive steps—such as maximizing contributions during working years and considering spousal Social Security benefits—to help offset these disadvantages.

More Conservative Investing

Studies show women tend to invest more cautiously than men. While being risk-aware can protect savings, avoiding growth investments can mean smaller long-term returns. Since inflation erodes purchasing power over time, overly conservative investments may not grow enough to sustain a long retirement.

A balanced approach is key. Women should aim for a diversified portfolio that includes stocks for growth, bonds for stability, and other assets suited to long-term financial security. Understanding investment options and seeking financial advice can help ensure savings keep pace with future needs.

Social Security and Pension Gaps

Social Security benefits and pensions are based on lifetime earnings. Because women often earn less and have career gaps, their benefits tend to be lower than those of men. This can create financial challenges in retirement, especially since women rely more on Social Security as a primary source of income compared to men.

Delaying Social Security can help increase monthly payouts, and women should explore spousal or survivor benefits if applicable. For pensions, understanding payout options—such as taking a lump sum or choosing survivor benefits—can make a big difference in financial stability. Careful planning can help women maximize their retirement income and close the gap caused by lower lifetime earnings.

Download your free guide to mastering taxes in retirement today!

What Women Can Do to Secure Their Retirement

Planning for retirement comes with unique challenges for women, but taking proactive steps can make a significant difference. From saving early to making informed Social Security decisions, here’s how women can build a more secure financial future.

Start Saving Early

Time is your best asset when it comes to retirement savings. The earlier you start contributing to a 401(k), IRA, or other retirement account, the more time your money has to grow through compound interest. Even small contributions can add up over time, especially when invested wisely.

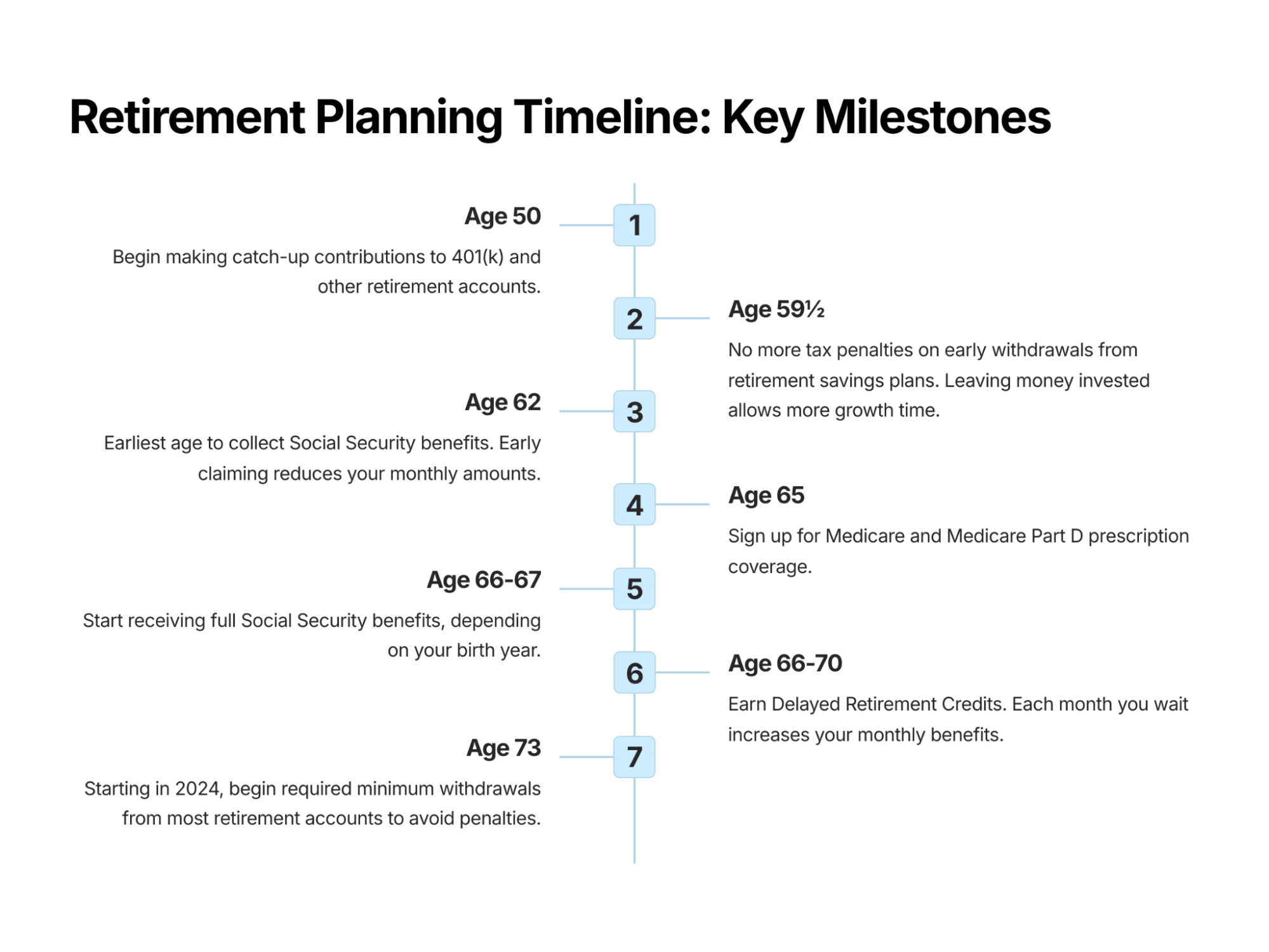

If you’re over 50, you can make catch-up contributions to your retirement accounts, allowing you to save even more in the years leading up to retirement. Taking advantage of this option can help offset career gaps and lower lifetime earnings.

Maximize Employer Benefits

If your employer offers a retirement plan, contribute as much as possible—especially if they provide a matching contribution. Many companies will match a percentage of your contributions, effectively giving you free money to invest in your future.

Be sure to check your plan’s vesting period, which determines how long you need to stay with your employer before you can take full ownership of their matching contributions. Leaving a job too soon could mean losing part of your retirement savings.

Invest with Growth in Mind

While security is important, being overly conservative with investments can limit long-term growth. Women tend to invest more cautiously than men, which can result in lower returns. A well-balanced portfolio should include a mix of stocks, bonds, and other assets to help protect against inflation and ensure steady growth.

If you’re unsure about investment options, consider working with a financial advisor to develop a strategy that aligns with your risk tolerance and long-term goals.

Plan for Healthcare Costs

Women tend to spend more on healthcare in retirement, in part due to their longer lifespans. This includes regular medical expenses, prescriptions, and potential long-term care costs.

Since Medicare doesn’t cover everything—especially extended care like assisted living or nursing homes—it’s important to plan ahead. Consider options like:

Long-term care insurance, which can help cover the cost of nursing homes, home health aides, or assisted living.

A health savings account (HSA) if you’re eligible, which offers tax advantages and can be used for medical expenses in retirement.

Take Control of Social Security Decisions

Since women often have lower lifetime earnings, Social Security benefits may not be as high as they are for men. One way to maximize benefits is by delaying Social Security payments until full retirement age (or even age 70), which can significantly increase your monthly payouts.

Women should also explore spousal and survivor benefits. If you’re divorced but were married for at least 10 years, you may be eligible for Social Security benefits based on your ex-spouse’s earnings history. Understanding your options can help you make the most of your retirement income.

Seek Professional Guidance

A financial planner can help you navigate retirement planning, ensuring you make the best decisions based on your personal situation. They can assist with investment strategies, Social Security timing, healthcare planning, and tax-efficient ways to withdraw retirement savings.

If you experience major life changes—such as divorce, widowhood, or a career transition—it’s especially important to revisit your retirement plan. A professional can help adjust your strategy and keep you on track for financial security.

Download your free guide to mastering taxes in retirement today!

Timeline for Retirement Planning

Building a Strong Retirement Income Plan

Retirement isn’t just about saving—it’s about creating a steady, reliable income stream to support your lifestyle. Since most people shift from earning a paycheck to drawing from multiple sources, having a clear plan is essential.

Understand Your Income Sources

Once you stop working, your income may come from Social Security, investment accounts, pensions, annuities, or part-time work. Knowing how these sources fit together will help you create a stable financial foundation.

Live Within Your Means

Managing expenses wisely is just as important as growing savings. Reducing debt, sticking to a budget, and avoiding unnecessary spending can help make your money last longer.

Automate and Increase Contributions

One of the easiest ways to stay on track is to automate savings and gradually increase contributions whenever possible. Employer retirement plans, automatic transfers, and reinvesting dividends can help grow your funds consistently.

Adapt as You Go

Retirement planning isn’t static—your goals, expenses, and market conditions will change. Regularly reviewing your plan and adjusting for life events ensures your strategy stays on course.

By taking a structured approach to retirement income, you can reduce financial stress and enjoy more financial freedom in your later years.

Download your free guide to mastering taxes in retirement today!

The Bottom Line

Women face unique financial hurdles in retirement, but proactive planning can help overcome them. Whether you're just starting out or nearing retirement, taking steps today can make a big difference in your future financial security.

Reference

Department of Labor. (n.d.). Women and Retirement Savings. Retrieved from https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/publications/women-and-retirement-savings

Department of Labor. (n.d.). Retirement Toolkit. Retrieved from https://www.dol.gov/agencies/ebsa/about-ebsa/our-activities/resource-center/publications/retirement-toolkit

Time. (2024). U.S. Life Expectancy Gender Gap. Retrieved from https://time.com/6334873/u-s-life-expectancy-gender-gap/

Harvard Health. (2016). Why Men Often Die Earlier Than Women. Retrieved from https://www.health.harvard.edu/blog/why-men-often-die-earlier-than-women-201602199137

U.S. Department of the Treasury. (n.d.). Spotlighting Women’s Retirement Security. Retrieved from https://home.treasury.gov/news/featured-stories/spotlighting-womens-retirement-security