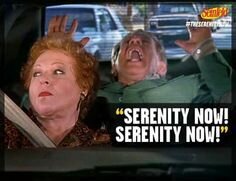

Serenity now...

A number of upcoming events, including the wackiest election in decades, could generate market volatility. Although our process still sees U.S. stocks and global government bonds as expensive, a market setback could provide us with a terrific opportunity to buy.

As we look back on the last three months, what stands out is how quiet financial markets were during the summer, and yet, as September rolled around and market fluctuations picked up, how much it paid to be diversified.

Central bank actions and inaction, as well as fears surrounding either, drove financial market swings during the most recent quarter. Against a backdrop of soft economic growth and weak corporate earnings, extremely low interest rates have driven investors to bid up the prices of financial assets, distorting markets in the process. Investors are now dependent on low rates continuing to bolster rising asset prices. Any sign this “easy money” interlude is nearing an end has triggered gyrations in the capital markets.

In viewing recent market performance, we keep coming back to one of our fundamental principles, that successful long-term investing is a marathon, not a succession of sprints. Focusing on how all the pieces of your portfolio together contribute to performance and less on what a specific investment is doing in any given quarter is the best way to avoid overreacting to temporary market declines.

Savvy investors should be extra cognizant of this as the U.S. presidential election draws closer. We are prepared for more financial market fluctuations going into the race’s final weeks, but we do not view that as a rationale to make tactical changes to our strategies. Uncertainty can lead to rash, poorly timed decisions that negatively impact your results. Maintaining diversified portfolios, managing risk, and riding out periods of uncertainty, however uncomfortable, are key to successful investing.

Given a current investment environment that features high uncertainty, and one that we view as offering lower overall return prospects compared with those of the past two decades, we believe the diversified portfolios we are managing are both resilient and well-positioned for long-term outperformance on a risk-adjusted return basis.

So enjoy the market serenity for now, but let’s be prepared for the potential insanity later. (Remember that Seinfeld episode?)

For a more indepth look into the data that drives our investment thesis, please see Russell’s Global Market Outlook report.