Decumulation Strategies: Navigating Retirement Withdrawals

Retirement marks the shift from accumulating wealth to managing withdrawals in a tax-efficient and sustainable manner. Known as decumulation, this phase requires new strategies to ensure financial stability and longevity. In this article, we'll explore the key components and benefits of decumulation strategies, leveraging insights from recent trends and expert recommendations.

What is Decumulation?

Decumulation is the process of spending down the assets you've accumulated over your lifetime during retirement. It involves planning for a steady income stream while managing risks like market volatility and longevity uncertainty. The goal is to ensure your money lasts throughout your retirement, covering both essential and discretionary expenses.

Get your FREE Retirement Plan Review today!

Advantages of Decumulation Strategies

Financial Confidence: Establishing lifetime income sources such as Social Security, pensions, and annuities provides a reliable income stream, giving retirees the confidence to spend without the fear of outliving their savings.

Risk Management: By securing guaranteed income for basic needs, retirees can reduce their reliance on market performance, thereby minimizing financial stress.

Lifestyle Flexibility: Effective decumulation allows retirees to design their preferred lifestyle, balancing between essential expenditures and discretionary spending like travel and hobbies.

Key Decumulation Strategies

1. Securing Lifetime Income Sources

Having guaranteed lifetime income is crucial for financial security in retirement. Here are the primary sources:

Social Security: Provides government-guaranteed income with inflation adjustments. The amount depends on work history and the age benefits commence.

Pensions: Offer defined benefit plans from employers, though these are becoming less common.

Annuities: Allow retirees to convert a lump sum into a stream of payments that last for life, often with options for spousal benefits and inflation adjustments.

Matching these income sources to basic living expenses ensures that essential needs are met, regardless of market conditions.

2. Drawing Down Savings

When lifetime income sources aren't enough, retirees can draw from savings in accounts like IRAs and 401(k)s. However, this involves careful planning to manage risks:

Market Volatility: Withdrawals during market downturns can significantly impact savings.

Longevity Uncertainty: Estimating how long your savings need to last is challenging.

To address these issues, retirees can work with financial professionals to determine sustainable withdrawal rates and consider tools like retirement calculators. Additionally, integrating annuities into the retirement portfolio can convert a portion of savings into guaranteed income, providing more stability.

Craft a Comprehensive Decumulation Strategy

Creating a successful decumulation strategy involves several key steps:

Detailed Expense Review: Understand your financial needs by reviewing anticipated retirement expenses, both essential and discretionary. This helps prioritize withdrawals and ensures that your income covers your lifestyle.

Account Analysis: Each retirement account has unique rules and tax implications. Analyzing these helps in strategizing an optimal withdrawal sequence. For instance, withdrawing from taxable accounts first can capitalize on lower capital gains tax rates, allowing tax-deferred accounts to grow longer.

Strategic Withdrawals: Develop a withdrawal plan that balances tax efficiency, market conditions, and personal goals. This might involve a mix of fixed and flexible withdrawals. For example, during market downturns, you might delay withdrawals from certain accounts to preserve growth potential.

Flexibility: Adapt your strategy as personal circumstances and the financial landscape change. Your plan should be revisited and adjusted as needed to respond effectively to these changes.

Professional Guidance: Consult with a financial planner to tailor strategies to your unique situation, ensuring all aspects of your financial picture are considered. A financial professional can help you develop a personalized decumulation strategy based on your risk tolerance and financial goals.

Managing Risks in Decumulation

One of the biggest challenges in decumulation is managing sequence of returnrisk. Sequence of return risk refers to the danger that the timing of withdrawals from retirement accounts will negatively impact the longevity of your portfolio. If you withdraw a significant amount of money during a market downturn, you could deplete your savings much faster than anticipated. To mitigate this risk, consider the following strategies:

Tax Efficiency: A key strategy in managing decumulation risk is to withdraw from taxable investment accounts first. By doing so, you can capitalize on lower capital gains tax rates, allowing your tax-deferred accounts to continue growing. (During this time, you may also be able to convert tax-deferred assets into tax-free Roth assets at favorable tax rates.) Once your taxable investment accounts are exhausted, you can then move on to tax-deferred accounts like IRAs and 401(k)s. This approach not only minimizes your tax burden but also maximizes the growth potential of your retirement savings.

Investment Preservation: Another important strategy is to delay withdrawals from investment accounts during market downturns. By adjusting your withdrawal strategy based on current market conditions, you can preserve the growth potential of your portfolio. For example, during periods of poor market performance, you might choose to live off cash reserves or guaranteed income sources like pensions and annuities, rather than selling investments at a loss. This helps to protect your portfolio from being depleted too quickly due to adverse market conditions.

Reliable Cash Flow: Ensuring that your withdrawals cover your living expenses without compromising the longevity of your portfolio is crucial. A well-thought-out decumulation strategy will provide reliable cash flow to meet your essential needs while preserving enough capital to sustain your lifestyle throughout retirement. This involves careful planning and possibly incorporating a mix of income sources, such as Social Security, pensions, annuities, and systematic withdrawals from savings. By diversifying your income streams and planning withdrawals carefully, you can maintain financial stability even in the face of unexpected expenses or market fluctuations.

The Future of Decumulation Strategies

The landscape of retirement planning is evolving, with a growing emphasis on personalized decumulation strategies. As more retirees seek tailored approaches to managing their retirement savings, the wealth management industry is responding with innovative solutions. Here are some key trends shaping the future of decumulation strategies:

Unified Managed Income (UMI): Unified Managed Income strategies are emerging as a holistic approach to retirement income planning. UMI considers all sources of income, including Social Security, pensions, annuities, and other investments. It provides a comprehensive plan that adjusts for inflation and ensures after-tax spending needs are met. This approach integrates various income streams to offer a seamless and reliable income throughout retirement.

In-Plan Managed Accounts: There is a growing trend towards in-plan managed accounts that offer personalized strategies for retirement income. These accounts factor in all external assets and cash sources, providing a tailored solution for each retiree. By incorporating managed accounts within retirement plans, retirees can benefit from professional management and advice without the need to rollover to an IRA, which can be costly and complex.

Regulatory Changes: Recent regulatory changes, such as the SECURE Act and Regulation Best Interest, are shaping the future of decumulation strategies. The SECURE Act, for example, allows for guaranteed lifetime income through retirement plan annuities, providing safe harbor provisions for plan sponsors. Regulation Best Interest ensures that financial advisors act in the best interest of their clients, enhancing the quality of advice and transparency in retirement planning.

Digital Tools and Robo-Advisors: The adoption of digital tools and robo-advisors is transforming retirement planning. These tools offer automated, personalized advice at a lower cost, making professional retirement planning accessible to a broader audience. Robo-advisors can help retirees create and adjust their decumulation strategies based on real-time data and market conditions, ensuring that their retirement income plans remain optimal.

Subscription-Based Advice: Subscription-based advisory services are gaining popularity as an alternative to traditional asset-based fees. These services provide continuous, personalized advice for a flat annual fee, making it easier for retirees to budget for financial planning services. This model aligns the interests of advisors and clients, focusing on long-term financial health rather than transaction-based revenue.

Adoption of Annuities in Retirement Plans: Annuities are becoming a more integral part of retirement plans. With the inclusion of annuities as Qualified Default Investment Alternatives (QDIAs), more retirees can access guaranteed lifetime income directly within their retirement plans. This trend is expected to grow, as annuities provide a valuable solution for managing longevity risk and ensuring a stable income.

Holistic Retirement Income Solutions: The future of decumulation strategies lies in providing holistic solutions that integrate all aspects of a retiree's financial life. This includes not only managing withdrawals but also considering factors such as healthcare costs, housing, and lifestyle goals. Financial planners will increasingly use advanced tools to create comprehensive plans that address the unique needs and circumstances of each retiree.

Get your FREE Retirement Plan Review today!

When to Seek a CERTIFIED FINANCIAL PLANNER™

Deciding when to seek the guidance of a CERTIFIED FINANCIAL PLANNER™ (CFP®) can be crucial for a successful retirement. Here are some key moments and scenarios when consulting a CFP® can make a significant difference:

Approaching Retirement: As you get closer to retirement, the complexity of your financial situation typically increases. A CFP® can help you transition from the accumulation phase to the decumulation phase, ensuring your retirement savings are managed efficiently and sustainably. They can assist in creating a comprehensive retirement plan that covers all aspects of your financial life.

Developing a Decumulation Strategy: Crafting a decumulation strategy involves making critical decisions about when and how to withdraw your savings. A CFP® can provide expert advice on optimizing your withdrawal strategy to minimize taxes, manage risks, and ensure a steady income stream. They can also help you decide the best way to incorporate guaranteed income sources, such as annuities, into your plan.

Managing Sequencing Risk: Sequencing risk, or the risk that the timing of withdrawals will negatively impact your portfolio, is a significant concern during retirement. A CFP® can develop strategies to mitigate this risk, such as adjusting withdrawals based on market conditions and ensuring you have sufficient cash reserves to weather market downturns.

Tax Efficiency Planning: Effective tax management is essential for maximizing your retirement savings. A CFP® can guide you on the most tax-efficient ways to withdraw your funds, taking into account the different tax implications of various accounts. They can help you create a plan that minimizes your tax burden while maximizing the growth potential of your assets.

Navigating Complex Financial Situations: If you have a complex financial situation, such as multiple income sources, investments, or properties, a CFP® can provide the expertise needed to manage these complexities. They can offer personalized advice tailored to your unique circumstances, helping you make informed decisions that align with your long-term goals.

Facing Major Life Changes: Significant life events, such as a change in health, the death of a spouse, or a sudden financial windfall, can dramatically impact your retirement plan. A CFP® can help you navigate these changes and adjust your plan accordingly to ensure continued financial stability.

Ensuring Comprehensive Planning: A CFP® can provide a holistic approach to retirement planning, considering not only your income and investments but also factors such as healthcare costs, insurance needs, and estate planning. This comprehensive view ensures that all aspects of your financial life are integrated and working together to support your retirement goals.

Gaining Peace of Mind: Perhaps most importantly, working with a CFP® can provide peace of mind. Knowing that a certified professional is helping you manage your finances can reduce stress and allow you to enjoy your retirement more fully. Their expertise and experience can help you avoid costly mistakes and make the most of your retirement savings.

Bottom Line

Shifting from wealth accumulation to decumulation requires a strategic approach to manage withdrawals effectively. By securing lifetime income sources, strategically drawing down savings, and managing risks, retirees can ensure their financial stability throughout retirement. Partnering with a financial professional can further refine these strategies, providing peace of mind and a sustainable income stream for the golden years.

For expert guidance tailored to your unique retirement needs, consider partnering with ONE Advisory Partners. Our team of CERTIFIED FINANCIAL PLANNER™ professionals can help you develop a comprehensive decumulation strategy that aligns with your financial goals. Visit ONE Advisory Partners to learn more and start planning for a secure and fulfilling retirement.

Get your FREE Retirement Plan Review today!

Reference

Optimal Retirement Asset Decumulation Strategies: The Impact of Housing Wealth

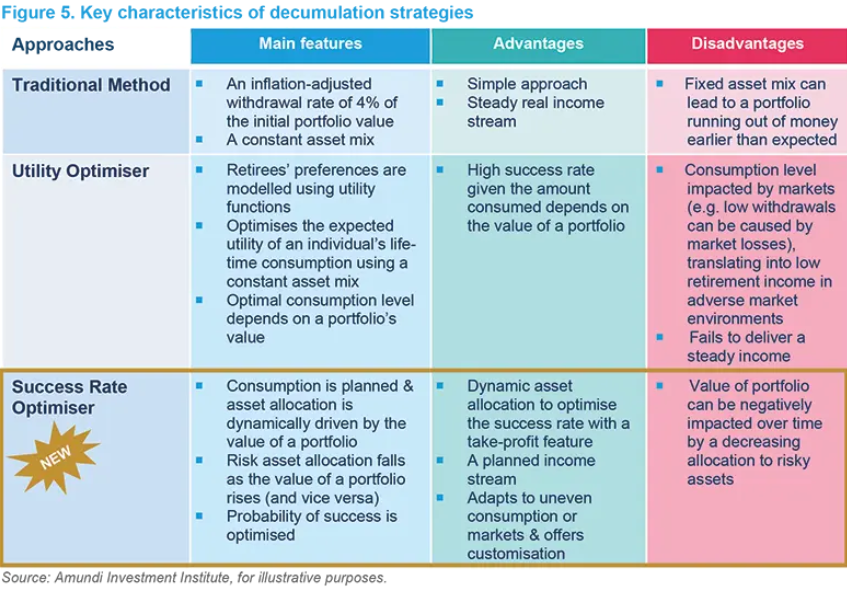

Amundi Research Center. Key findings Optimal decumulation strategies

U.S. Congress. Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019.

U.S. Securities and Exchange Commission. Regulation Best Interest.

Certified Financial Planner Board of Standards, Inc.. The Importance of Consulting a CERTIFIED FINANCIAL PLANNER™ (CFP®).